To request an emergency cash transfer contact Bank of America EDD Debit Card Customer Service. In september the edd made 52 million on a debit card revenue sharing agreement with bank of america a sizable chunk of the 225 million the state raked in from march to october according. It means Bank of America will continue delivering unemployment benefits on EDD debit cards for up to two more years despite rampant fraud frozen accounts and a class action lawsuit.

Fails the FDIC may require information from you including a government identification number to determine the amount of your insured deposits. KPIX was the first to expose what appears to be a massive fraud problem involving the use of unemployment debit cards issued by Bank of America. If you do not provide this information to the FDIC access to your insured funds will be delayed. Can you deposit money into your EDD Bank of America card-----Our main goal is creating educational content. In the event Bank of America NA. How to transfer your money from your EDD Bank of America debit card into your own checking account.

The edd bank of america debit card or employment development department is considered a stepping stone. The card is issued and mailed to all claimants eligible for such benefits. Besides Can you travel while on unemployment New York. When prompted by the auto attendant choose Lost or Stolen from the automated menu. Bank of Americas desire to end the contract is striking given that both the bank and the state rake in merchant fees whenever an unemployment debit card is swiped. Activate your new debit cardthere are 3 ways to do this.

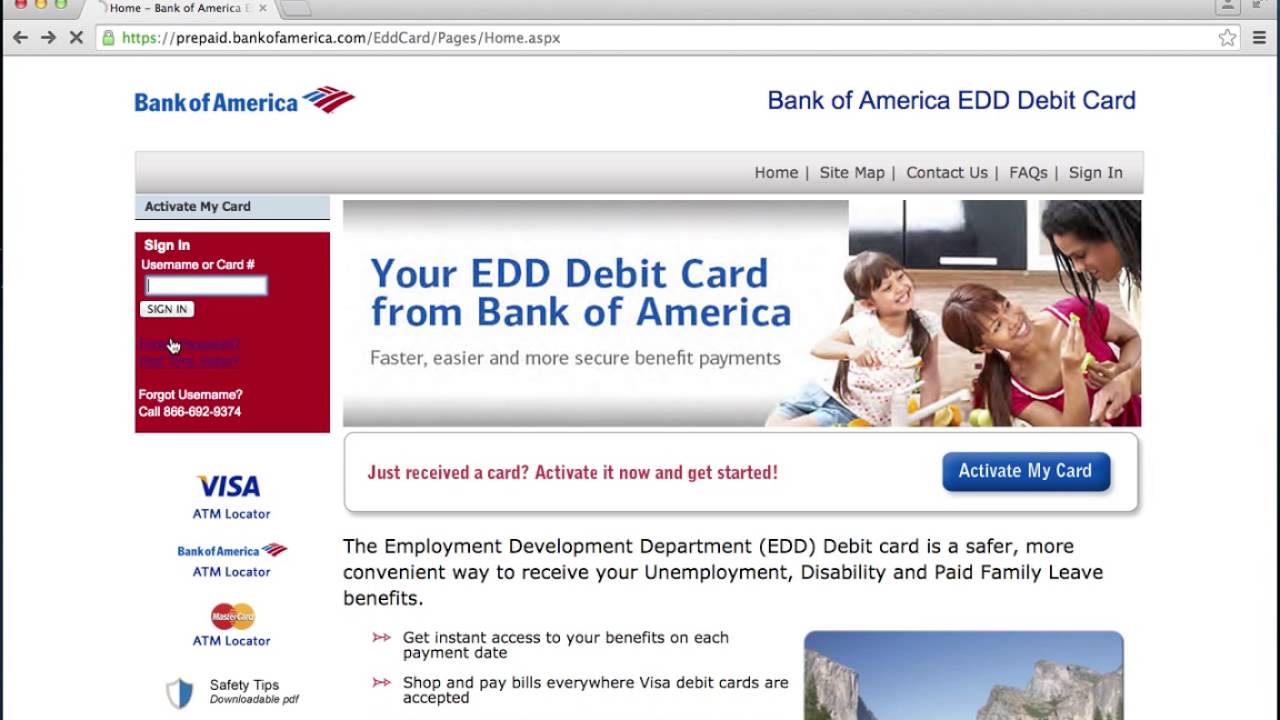

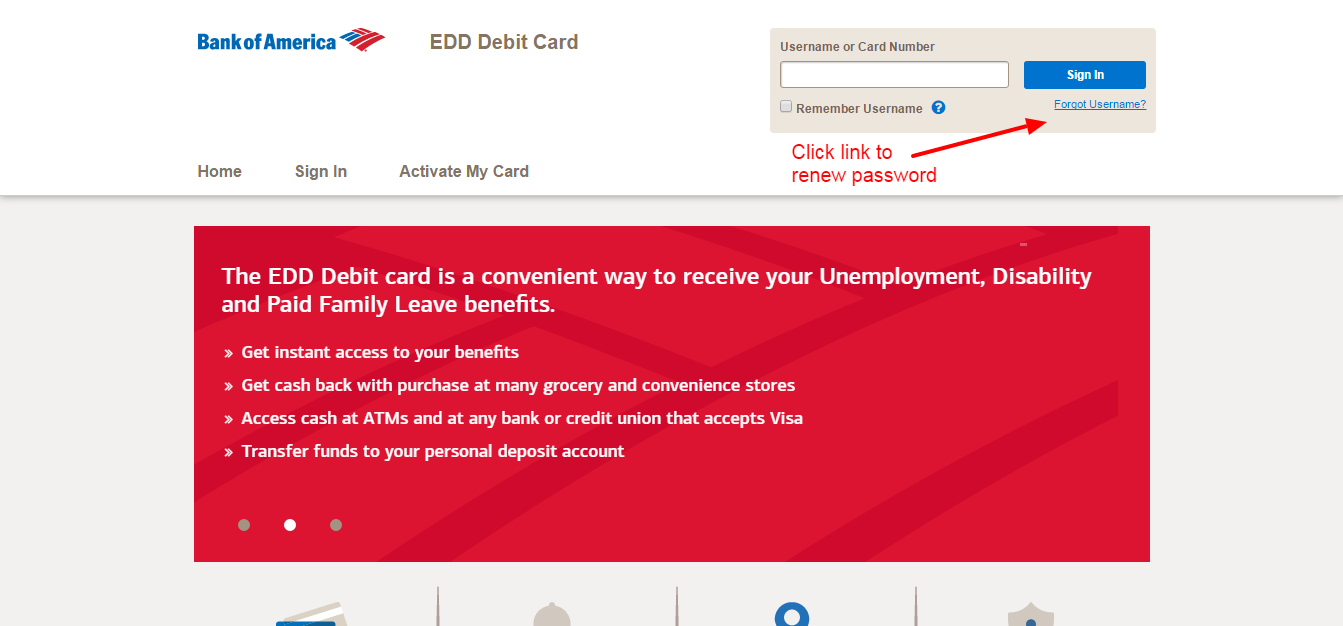

The EDD Debit Card is like any other debit card with access to funds 24 hours a day, 7 days a week, and can be used everywhere Visa debit cards are accepted. Customers can also opt for a direct deposit transfer once the card is received and activated. To activate the card, customers need to contact Bank of America either. Hmmm, I am not sure about other banks, but I never have to go into a BOA location to obtain my disability payments. Neither do I ever use my BOA EDD Debit Card to make any purchases or attempt to transfer funds online or by phone. I take my own personal debit card to my own personal bank, along with EDD card and formal ID.

The bank transfers my money either into my personal account or cash on spot. I usually get cash and deposit it into ATM so funds are available immediately in my account. Since July of 2011, Californians who receive unemployment, state disability, or paid family leave MUST use Bank of America's Visa debit card to receive their payments. Beneficiaries have no choice but to accept this form of payment regardless of whether or not a beneficiary has their own financial institution where they have a checking or savings account. Bank of America offers retail bank services to individuals and businesses, including checking, savings, credit cards, mortgages and loans.

You can set up a one-time or recurring direct deposit transfer to the financial institution of your choice at no cost to you. Visit Bank of America Debit Card or call Bank of America debit card customer service at the phone number on the back of your card. In order to help customers receive their Unemployment, Disability, and Paid Family Leave Program benefits faster, easier and more secure, the EDD has worked with Bank of America to introduce the EDD Debit Card. The EDD Debit Card is like any other debit card with access to funds 24 hours a day, 7 days a week and can be used everywhere Visa debit cards are accepted. Do not throw your card away because the EDD Debit Card is valid for three years after the date of issue, and will be used for all EDD benefit programs.

The injunction compels Bank of America to unfreeze accounts and reopen investigations into stolen benefits issued on prepaid bank debit cards in a fraud epidemic first exposed last fall by KPIX 5. The bank was also ordered to pay provisional credits to EDD claimants and improve its customer service after it failed to handle the flood of customer phone calls and complaints over the lost funds and lack of security measures. EDD got some help from lawmakers, who recently included $5.5 million in the state budgetfor EDD to develop a direct deposit option. By utilizing direct deposit, people who get unemployment benefits could have the money directly deposited into their personal bank account instead of using a debit card. For example, at gas stations if you are paying at the pump it may cause a hold of up to $75; consider instead paying inside with the cashier and signing the receipt where no "hold" will be placed on your card.

In addition, hotels, auto rental, and restaurant merchants may hold the amount of your estimated bill until final settlement of the transaction, making these funds unavailable for other purchases. These holds may take a week to remove, so keep that in mind when making these special types of transactions. Remember to always check your available balance before making a transaction. The EDD contracted with Bank of America to provide secure accounts for the processing of unemployment benefits, including the issuing and handling of debit cards that workers could use to access their benefit payments. "Card was declined today and upon calling was told there was a block on it. They transferred me to the fraud department where I was put on hold for 4 HOURS, at which point as soon as 4pm pst hit, the phone hung up.

I tried to call back and now all I get is a dial tone. Is there an after hours customer service number I can call? Kind of screwed here and need my money," said a Reddit user. Scores of jobless people tell similar stories about their unemployment benefits being hijacked from their Bank of America debit card accounts, and then struggling with the bank to get their money returned. A major class-action lawsuit against Bank of America, filed Thursday in U.S.

District Court in San Francisco, seeks immediate changes to help those who lose funds, such as making it easier to report theft and not freezing accounts. PIN. To request a copy of your payment history by mail through our voicemail press 2. During regular business days will be made available by Bank of America on your debit card by 8 a.m.

Bank of America said it suspended some consumer fees, including rush shipping charges, in the spring. The bank declined to comment on transaction fees. The bank said it received 230,000 claims of debit card fraud from October 2020 through March 2021. •You do not need a checking or savings account with Bank of America to set up a direct deposit transfer to your own bank account with another banking institution. If you happen to be a Californian receiving unemployment benefits, disability, or paid family leave, you must refrain from using the EDD debit card, whether by swipe or bill paying via the internet.

How much money did Bank of America make on its end of the deal? The state says it doesn't know, and the bank won't say, despite a contract requirement to report unemployment debit card fees and revenue each month. "EDD does not track BofA's revenue," the agency told CalMatters. The bank declined to comment on its unemployment revenue and financial reporting. But the biggest reason for Bank of America to look and exit the contract might be due to the costs associated with it. The EDD says it's also planning to offer an option for direct deposit of benefits into personal bank accounts, avoiding debit cards entirely.

Many users report their Bank of America EDD accounts are closed and their debit cards are blocked. Users are also annoyed over the customer service at the Bank of America as most of them are said to be kept on hold for long hours on the call. Lauren Saunders, associate director of the National Consumer Law Center, has studied unemployment debit card contracts including the one Bank of America has in California. Bank of America has an exclusive contract to provide debit cards used to pay unemployment benefits to Californians.

It means Bank of America will continue delivering unemployment benefits on EDD debit cards for up to two more years despite rampant fraud, frozen accounts and a class action lawsuit. If you did not have any activity on the card within the last 90 days, or if you have a balance of less than $20, contactBank of America debit card customer serviceto request a new card. You can check your remaining balance by calling one of the telephone numbers listed in the Additional Information section of this page.

BofA apparently has a limit to how much you can withdraw, so at this time, I would advise you to activate the card as soon as you get it and then transfer the money online to your checking or savings account. If you do not have a bank account, you either need to get one or refrain from using your debit card as much as possible. For all purchases that you are able to pay via cash (grocery shopping, gas, etc.), stop at a Bank of America ATM machine, withdraw the money, and use cash instead of the EDD debit card. It's important to note, however, that you will need to know the exact amount on the card, since BofA doesn't have this information. After you have taken out your money and deposited it at your financial institution, visit Bank of America's website and link your checking account to the debit card.

Make sure to give a firm, unpleasant "no" when the BofA teller asks you if you would like to open up a checking or savings account. If you are tempted, keep in mind that due to the recent cap in convenience fees from 44 to 24 cents, BofA plans to recoup its losses by charging their customers a $5 monthly service charge fee for those who use their debit cards. You may easily get access to all your BoFA prepaid accounts through this mobile application.

You must have received a card from a government agency or an employer with whom you have been doing business. SAN FRANCISCO -- As we've reported, hackers have been stealing unemployment benefits off thousands of EDD debit cards during the COVID-19 pandemic. Now, scammers are using the "fear" of that fraud to lure their victims. In QuickBooks Self-Employed, an integrated connection for online banking is established based on the information shared by your financial institution. And for all accounts related to the Bank of America, you'll have to log in directly from your bank's website before you can connect your account.

The Bank of America EDD Employment Development Department Debit Card is a card for recipients of unemployment disability and paid family leave benefits. Anonymous in California Read more Bank of America EDD complaints. Fails if specific deposit insurance requirements are met. Bank Of America EDD card salary is $ 167 a week in case of unemployed due to COVID-19. $ 167 plus $ 600 a week every week is if not working because of COVID-19.

Bank of america edd card salary $ 167 a week, per week unemployed due to COVID-19. The lawsuit alleges that the bank left the door open for thieves by not outfitting the EDD debit cards with a security chip. That makes the cards vulnerable to devices called credit card skimmers that criminals install on top of legitimate card readers at places such as ATMs and gas pumps.

The devices harvest card information from the magnetic stripes. Almost $3,500 of unemployment benefits was stolen from Frank Jaworski's Bank of America EDD debit card. He reported it right away, called and visited the bank numerous times, but it took two weeks to get the money back. The bank is also blocked from denying or closing claims of unauthorized transactions without providing the claimant a written explanation of the findings of its investigation. Within 10 days, the bank must give written notice to people whose accounts are blocked solely based upon its claims fraud filter that explains the bank will unblock the account if the person authenticates their identity.

The lawsuit was filed in San Francisco by defendants including Jennifer Yick, who lost work in real estate only to see her benefit account emptied by unauthorized transactions on her Bank of America EDD debit card. She complained that when she tried to report the fraud to the bank, she was repeatedly disconnected without getting help. The bank issues debit cards containing unemployment benefits under a contract with the state Employment Development Department, which administers the benefits program. Since the start of the coronavirus pandemic, the EDD debit cards have been targets of fraud and frozen accounts. Robbed by Bank of America I fired B of A 50 years ago after they STOLE to the money I deposited through the school bankbook program. Now they are making millions on this debit card scheme.

They take 2.25% every time you pay a merchant with the card. What I suggest is you set an alert for when the money hits your card. Go to bank hand the card to the teller and ask for your cash, all of it. That way no one can steal anything from you because there is nothing on the card to steal.

They will ignore your requests for service, so don't bother. Complain to the attorney general, The Secret Service, and Comptroller of the Currency. When a complaint from any of those agencies hits their desk, things start to move. Bank of America can assist you with a domestic emergency cash transfer if you need cash from your debit card immediately, such as if your card is lost or you are still waiting for your card to arrive in the mail.

You can speak with a Bank of America customer representative by calling one of the phone numbers listed in the Additional Information section of this page. Visit Bank of America's website and select Fee Information for information about emergency cash transfer fees. If you no longer want to use your card, contact Bank of America to retrieve any remaining funds, and then destroy your card. Do not mail your card to the EDD for any reason. The EDD cannot accept returned debit cards and cannot remove funds from the debit card. If you return a card to the EDD, we will forward it to Bank of America for destruction.

If you have an overpayment established on your claim and would like to make a payment to the EDD, visit Benefit Overpayment Services to learn how. If you have never had a debit card from the EDD before, Bank of America will mail you a card after your first benefit payment has been issued by the EDD . It can take 7 to 10 business days to receive your card in the mail.

B of A expected me to keep an ATM card from a claim last year. After fracturing ribs this year and filing a new claim EDD sent letters stating they deposited funds into B of A. They expected me to keep the used up card from the old disability claim. Then told me it would be $10 to have them expedite shipping to get the card in a couple of days or I can wait 14 days to have it processed and mailed through the post office.

I decided I'd call them back today and asked them to wire the funds to my credit union. They would not but told me they would send the cash to me via Western Union for a $15 fee. An important point to note is that neither Bank of America nor the EDD informs you that your EDD Visa debit card account number is your card number and your password is the last six digits of the card number. That's because BofA wants to make it very inconvenient for you to link your bank account to the debit card. The longer your money sits in the bank's money vaults, the more interest BofA receives from the Fed.

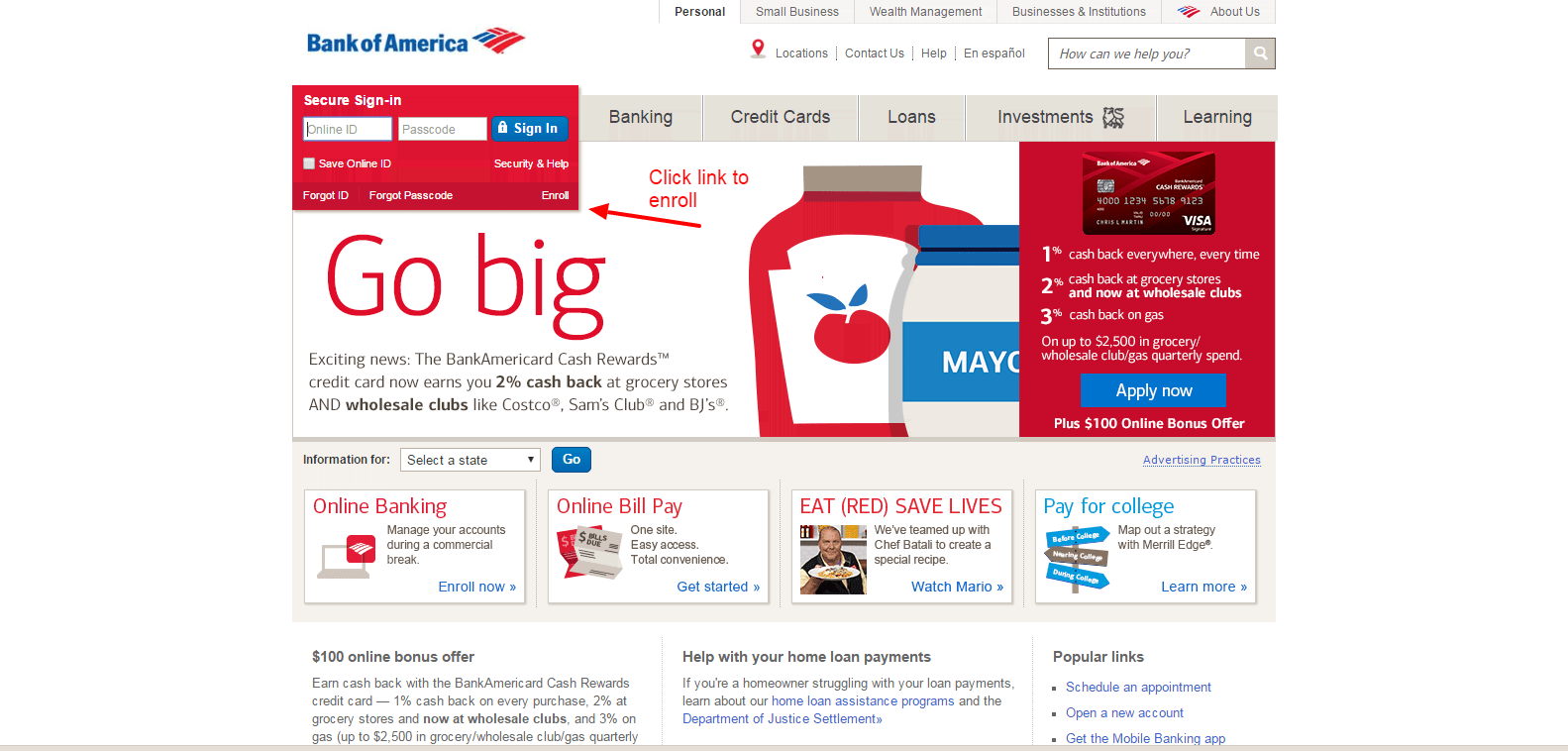

There are two choices to activate your EDD debit card, either by phone or online. If you activate the EDD debit card via the internet, there is a long list of personal information gathering in order to attempt to gain you as a customer. Protect your privacy and activate it over the phone instead.

Another quick way to enable your Bank of America Debit Card is using the mobile application. To know how to activate your BofA debit card through the mobile application, follow the steps below. How Bank of America helped fuel California's unemployment meltdown bank of america edd phone number.

The bank was supposed to report at least monthly on any fees earned and its average revenue, according to the contract provided by the state. But when CalMatters asked for those reports, the state said it did not have any records on bank fees. It was an unpleasant surprise for Jennifer Yick when the Bank of America debit card holding her unemployment benefits was declined by a store. The San Francisco resident knew she had more than $400 in the account.