Now recognized as one of the largest financial institutions in the U.S., the bank offers more than 2,000 branches and 9,000 ATMs across 19 states in the Midwestern and East Coast regions. PNC Bank additionally offers a wide range of products, including checking and savings accounts, certificates of deposit , IRAs, a money market account and a mobile banking app. Like most banks, PNC also offers a convenient online banking option. One of the bank's most popular features is its Virtual Wallet online and mobile service. This service provides users easy access to their money through digital means. Your browser must have Javascript enabled and be able to support frames to use PNC Online Banking.

In this guide we will teach you how to sign up for a PNC Bank Online Banking account. Is a bank holding company and financial services corporation based in Pittsburgh Pennsylvania. With PNC internet banking you can check balance pay bills view transaction history and more. Choose PNC for checking accounts credit cards mortgages investing borrowing asset management and more all for the achiever in you.

PNC has the right banking products and financial expertise for individuals small businesses and large institutions. PNC online banking makes banking convenient as it let their digital banking tools make everyday transactions easier to maintain on your time. PNC Online Banking provides you with the tools to take control of your money and to simplify how you manage your finances. Read a summary of privacy rights for California residents which outlines the types of information we collect and how and why we use that information. Download your balances and transaction information.

Customers who have a bank account with the bank visit the website and login anytime provided they have valid login details. See the mobile banking terms and conditions in the PNC Online Banking Service Agreement. Pay bills Add your bills and make one-time or recurring bill payments right from the app. The customer videos on this site are non-paid testimonials by real PNC customers.

Depending on their location customers can earn up to a 300 sign-up bonus with a checking short-term savings and long-term savings combo called Virtual Wallet. Transfer funds Transfer funds between eligible PNC accounts and external bank accounts ii. Pay bills transfer funds between PNC Bank accounts 1 stop payments and order checks. With PNC Bank Online Banking and Bill Pay Service we strive to protect your personal and financial information and to process your online transactions in a timely and accurate manner. PNC Bank is the seventh-largest bank in the country by assets. Its banking subsidiary PNC Bank operates in 21 states and the District of Columbia with 2296 branches and 9051 ATMs.

PNC offers two savings options in the Virtual Wallet bundle. Chase offers a combination of 5,1000 branches and 16,000 ATMs in 33 states, making its position as the largest bank in the U.S. one that's well-earned. Along with providing typical checking and savings accounts, CDs and IRAs, Chase also allows you access to your money through online and mobile banking features.

Its online banking option and mobile app are easily navigable and give you the perfect out to visiting branches or ATMs on days when you'd rather stay home. Even PNC's premium accounts allow you to waive fees through direct deposit, a policy most banks don't follow. In addition, the saving and budgeting tools add a way to organize your finances with the Virtual Wallet account package. A few other banks also package checking and savings accounts together, but PNC's Virtual Wallet actually provides tools to help you use the accounts together in a logical way. Find the latest PNC Financial Services Group I PNC stock quote history news and other vital information to help you with your stock trading and investing.

In this video well be showing you how to login to PNC bank online banking. This guide will be covering all the steps involved in creating an online account with. Use the electronic register to manage your checking account. We also considered factors such as insurance policies, users' deposit options, other savings accounts being offered by the same bank and customer reviews when available.

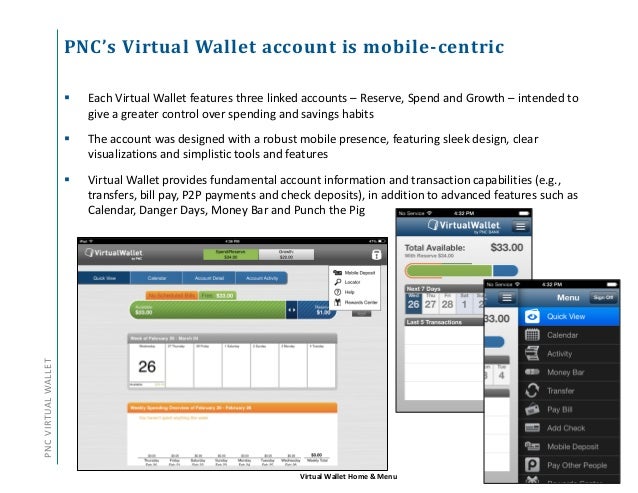

Our online digital features and mobile banking app make it easier than ever to bank from anywhere. You can check your balances, pay bills, transfer funds, set alerts, and more 24/7 from one place – your laptop, smartphone, or tablet. Depending on their location, customers can earn up to a $300 sign-up bonus with a checking, short-term savings and long-term savings combo called Virtual Wallet. The trio of products — named Spend, Reserve and Growth, respectively — comes with a nice set of online management tools. But the interest rate on short-term savings is low, and it takes effort to avoid monthly fees on the checking account.

Manage your cards View and manage your PNC credit debit and. PNC Bank offers internet banking services and this has made it easy for customers to manage their bank accounts. After that we will guide you through the login process. 1Send Money with Zelle® is available for most personal checking and money market accounts.

To use Send Money with Zelle® you must have an Online Banking profile with a U.S. address, a unique U.S. mobile phone number, an active unique e-mail address, and a Social Security Number. Your eligible personal deposit account must be active and enabled for ACH transactions and Online Banking transfers. To send money for delivery that arrives typically within minutes, a TD Bank Visa® Debit Card is required.

Message and data rates may apply, check with your wireless carrier. When there's so many banks to choose from, it can sometimes be difficult to make the right choice for your specific financial needs. Most big banks offer similar services, including checking and savings accounts, CDs and online and mobile features. However, the rates and terms for those products differ. You'll need to identify your savings plans and whether they align with the services and rates offered by the bank you're researching. All of the accounts included on this list are FDIC-insured up to $250,000.

Note that the interest rates and fee structures for brick-and-mortar savings accounts are subject to change without notice. Product and feature availability vary by market so they may not be offered depending on where you live. Most brick-and-mortar banks require you to enter your zip code online for the correct account offerings. Any return on your savings depends on the associated fees and the balance you have in your brick-and-mortar savings account.

To open a savings account, most banks and institutions require a deposit of new money, meaning you can't transfer money you already had in an account at that bank. You will need the recipient's mobile number or email address to get started transferring money with Popmoney and PNC Bank. Yes, PNC has a free mobile banking app available on both Apple and Android devices. The app allows 24/7 access to your bank account and PNC products and services, including transferring money and paying bills. Make deposits Deposit checks quickly and easily with your Android device iii. When you use Online Bill Pay our goal is to make your electronic payments as.

Its key shortcoming is the same as that of all brick-and-mortar banks -- its APYs just can't keep up with those offered by online banks. But its budgeting tools and its mobile app can make up for this difference, making it a good fit for beginner savers. PNC and Chase equally offer relatively similar products, but account types, fees and conditions are different for each bank. PNC offers two savings account options, including one for children.

This includes the PNC Standard Savings and the PNC "S" is for Savings accounts. The checking accounts the bank offers include the PNC Bank Standard Checking account, the Bank Performance Checking account and the Performance Select Checking account. The Standard Checking account does come with monthly fees, but these are waivable. In addition, the account reimburses you for any out-of-network ATM fees.

The other checking accounts' monthly fees are waivable. Both PNC and Chase Bank offer a long list of banking products that can be conveniently accessed across the nation. Whether it's checking and savings accounts, or branches, ATMs and mobile apps, both banks provide users access to relatively similar products.

However, the details of those products are different at each institution. Below, we take a closer look at the accounts, rates and services provided by PNC vs. Chase Bank to help you choose the bank that's best for you. Valley's Online Banking and Mobile app offers convenient, secure access to your Valley accounts anytime, anywhere. Check your balance, view statements, pay bills, deposit checks and transfer money from your computer, tablet or mobile phone. You can quickly and securely deposit checks with Mobile Deposit using your smartphone or tablet.

You'll also have access to your accounts to check balances, access your Fulton Bank Credit Card accounts, track recent transactions, and manage your money. External transfer services are available for most personal checking, money market and savings accounts. To use these services you must have an Online Banking profile with a U.S. address, a unique U.S. phone number, and an active unique e-mail address. Ally Bank is a nice alternative if you want great customer service and high APYs. The bank doesn't have any branches, but because its overhead costs are lower, it can offer you much higher interest rates. The Ally online savings account, for example, offers a jaw-dropping APY with no monthly maintenance fees.

You won't find any relationship benefits here, but Ally Bank offers a wider range of products than you usually see with an online bank,. When deciding whether to open an account with PNC vs. Chase, you should note that both financial institutions basically offer all the banking services you may need. Both banks, however, offer less competitive interest rates when compared to online-only banks, so you'll want to keep that in mind when making your final decision.

Developed in conjunction with CashEdge Inc., a provider of money transfer capabilities, the service is free for all PNC customers and available as part of PNC's online banking system. The person-to-person payment service lets customers send money using just an email address or mobile phone number. While you can get a stand-alone checking or savings account, there's no information online about how to open one. You'll want to spend some time doing your homework before opening an account.

Consider combing through the details on the website or speaking to a customer rep to get your questions answered. If you find PNC's Virtual Wallet products appealing and meet the criteria to get the monthly maintenance fee dropped, it could be worth your while to open an account. Also, if you prefer to bank with a large financial institution with a host of offerings, it might be right for you. PNC has a handful of mobile banking apps available on both iOS and Android devices.

With the apps, you can check your account balances, pay bills, transfer money and deposit checks directly from your mobile device. The apps have outstanding ratings, and the PNC Mobile Banking app is currently ranked #55 for all Finance apps on iOS, with a 4.8-star rating. PNC Virtual Wallet typically combines checking and savings accounts in a package with online money management tools, though it does exist as a product containing just a checking account. Product options vary by location with some places having up to four Virtual Wallet versions to choose from.

If you don't opt for the Virtual Wallet package and open just a single savings account, your interest rate will drop from the relationship bonus of 0.06% to the standard 0.01%. As long as you maintain the minimum waiver balance or set up automatic transfers of at least $25 from your checking, you won't be charged a maintenance fee. Most people won't join PNC just for its interest rates, but the bank's options for savings goals and automatic transfer setup can be useful if you need motivation to save. Get direct access to your Valley accounts anytime, anyplace with our mobile app. Access mobile deposit and card management features like requesting a debit card, change your PIN, temporarily lock or unlock your debit card and set travel notifications.

Upon sign in, you'll be able to see the current and available balances for all your checking, savings, money market, credit card, HELOC, installment loan, mortgage, CD, and IRA accounts. You'll start to see transactions (checks cleared, deposits, etc.) on the next business day. All online banking services are subject to and conditional upon adherence to the terms and conditions of the PNC Online Banking Service Agreement. Online bill pay is a free service within PNC Online Banking that is available for residents within the US who have a qualifying checking account. Zelle should only be used to send or receive money with people you know and trust.

Before using Zelle to send money, you should confirm the recipient's email address or U.S. mobile phone number. Neither PNC nor Zelle offer a protection program for authorized payments made with Zelle. Zelle is available to almost anyone with a bank account in the U.S.

Transactions typically occur in minutes between enrolled users. Your account comes with a linked debit card, and mobile and online banking. PNC also offers smart ways to save and budget, with handy online tools available to plan your finances and watch your money grow. The PNC Bank Standard Savings account is a standalone account you can open at a branch location or online. Like most brick-and-mortar savings accounts, it charges a monthly maintenance fee.

There are several ways to waive it, though -- and they aren't that difficult to achieve. The account also has a minimum opening deposit requirement and a minimum ongoing balance requirement to earn interest. However, these minimums are so low they're unlikely to keep anyone from opening an account. PNC Bank makes it easy for Penn State students to keep track of their money.

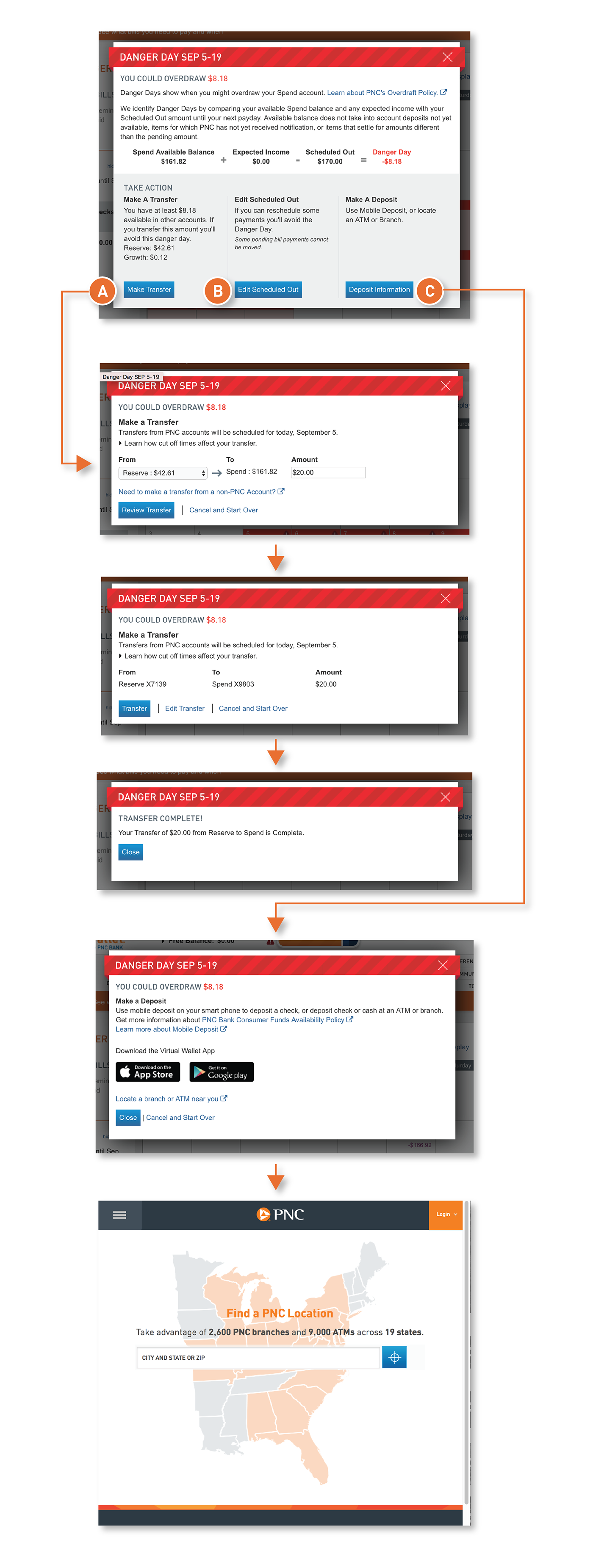

PNC offers banking tools designed especially for students. 2There's no charge to link and it's easy to do online. PNC Bank also offers technologies both online and in the mobile app to help you budget and spend wisely, to know when your balance is low and to stick to your savings goals. For example, Money Bar®displays the money you've set aside for bills and what's left over / free to spend. When the money in your Spend account is low, Danger DaysSMappear on your calendar so that you can adjust your spending or transfer money from your savings. Traditional brick-and-mortar savings accounts can be a simple but stable solution for keeping your money secure.

They mostly all earn the same interest rate, come with minimum balance requirements and monthly fees. Account holders also have access to their thousands of in-person branches and ATMs, one of the most common reasons why people opt for big banks. Virtual Wallet Spend, one of PNC's basic checking accounts, has free mobile banking and online bill pay. If you use a non-PNC ATM, the bank may also reimburse some ATM usage fees, depending on where you live, though the machine's owner could still charge a separate fee. PNC's entry is a full-featured app powered by mFoundry. Along with balance and transaction activity, it includes bill pay, funds transfer, and an ATM finder with location-based capabilities.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.